Produits

Inspiration

Vidéos recommandées Découvrez comment d'autres utilisateurs utilisent Prezi Video pour captiver leurs audiences. Présentations réutilisables Parcourez quelques-unes de nos présentations favorites et copiez-les pour les utiliser comme modèles. Infographies réutilisables Personnalisez le contenu de ces infographies pour créer vos propres œuvres d'art. Modèles de présentation Prenez une longueur d'avance en créant vos propres vidéos, présentations et infographies.Solutions

Business

Pour le marketing Créez des messages marketing percutants et personnalisés qui engagent n'importe quel public. Pour les ventes Découvrez comment personnaliser vos messages commerciaux pour améliorer la relation client. Pour les ressources humaines Rendez les contenus importants plus attrayants et mémorables avec Prezi.Ressources

Apprendre

Tutoriels des produits Apprenez à maîtriser Prezi en regardant ces vidéos rapides et faciles à suivre. Astuces de présentation Réservez un créneau avec un expert formateur Prezi pour aider votre équipe à se démarquer. Ressources éducatives Une collection de ressources éducatives et de bonnes pratiquesConnecter

Les séminaires en ligne Besoin d'aide avec une présentation, une vidéo ou un graphique ? Parlez à un expert dès aujourd'hui. Blog Prezi Lisez les dernières nouvelles et astuces de nos experts maison et sectoriels. Salle de presse Prezi Apprenez de nos experts, influenceurs et leaders d'opinion dans nos webinaires et forums.

Créez des présentations zoomantes interactives qui captent et conservent l'attention.

Apparaissez au cœur de votre contenu alors que vous présentez à votre audience.

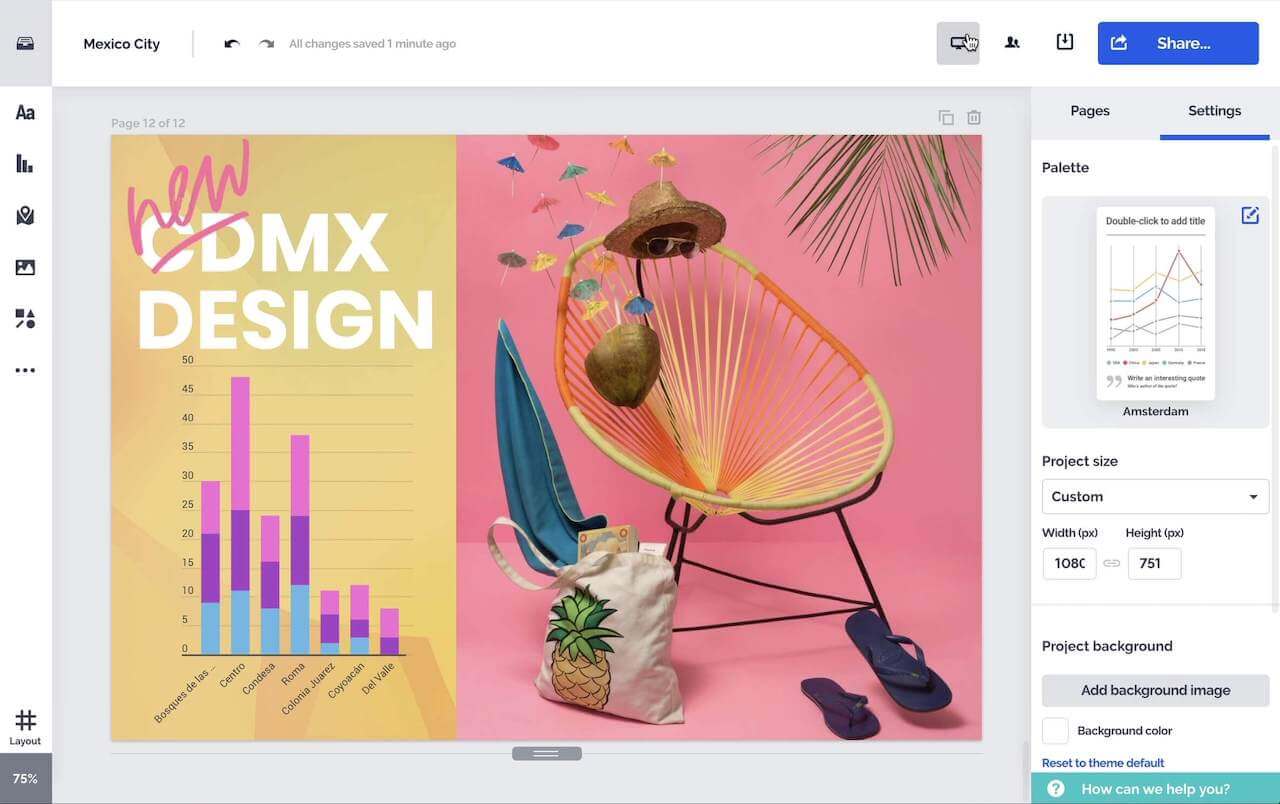

Créez des graphiques, rapports, cartes, infographies et d'autres éléments interactifs époustouflants.