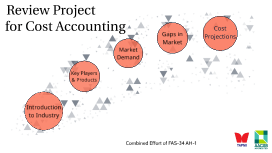

cost accounting

Transcript: sales 3,600 less: selling and administrative 300 additional costs 800 1,100 net realizable value of by product 2,500 total production cost of main product 150,000 less: net realizable value of by-product 2,500 Expected value of by product 147,500 x Sales 200,000 less: cost of goods sold 0 direct materials 0 direct labor 0 factory overhead 0 total manufacturing cost 150,000 less: inventory-jan. 31 30,000 120,000 gross profit 80,000 less: selling and administrative 60,000 net operating income 20,000 add: revenue from by-product 1,600 net income 21,600 25,000 how to solve for inventory? By-Product Main Product total manufacturing cost problem 11 pg.378 requirement C - Reversal Cost Method net income by-product treated as deduction from the cost of goods sold sales 2,700 less: add'l processing cost 800 selling & administrative 300 1,100 net revenue of by product 1,600 net by-product income treated as other income requirement C - net realizable value inventory-jan.31 = sales 250,000 less:marketing and administrative 60,000 total share in joint cost 190,000 Product: SUGARCANE main product and by-product 150,000 sales 200,000 less: cost of goods sold 0 direct materials 0 direct labor 0 factory overhead 0 total manufacturing cost 150,000 less: inventory-jan. 31 30,000 cost of goods sold 120,000 less: revenue from by-product 1,600 118,400 gross profit 81,600 less: selling and administrative 60,000 net income 21,600 = = x Blackberry Company by-product sales Units produced sales 3,600 less: marketing and administrative 300 additional cost 800 expected gross profit 1,080 2,180 total share in joint cost 1,420 30,000 5,000